PAI celebrates its 10-year anniversary of signing the PRI

The key ESG landmarks this past year

For PAI, 2019-2020 marked a new phase in our ESG journey. We are even more aware than before of the impact of ESG factors on the performance of our portfolio companies and we are continuing to reinforce our commitment to these issues by allocating appropriate resources, increasing our level of interaction with management teams, and accelerating support for best-in-class initiatives in our portfolio.

We are continuing to expand our dedicated ESG Team who, in close collaboration with our Investor Relations and Finance Teams, ensure seamless communication with our investors as they become increasingly involved in these key matters. We have now also incorporated the team into the PAI Performance Group (PPG), which focuses on operational improvements in our portfolio. We see this as a natural evolution of these two groups, driven by the understanding that ESG factors can play an important role in creating value at an operational level in our portfolio companies.

The impact of COVID-19

As responsible shareholders, we have helped our portfolio companies to address the many unexpected challenges arising from COVID-19. We have been working with management teams even more closely than before, providing support on a variety of issues ranging from the management of human capital, the effort to address any necessary adjustments to operations, and the establishment of more sustainable supply chains. Acting in such close collaboration with our portfolio companies has allowed us to provide them with support and expertise during this unprecedented time, which has had a lasting, positive impact on how we work together.

From an ESG perspective, it has been our portfolio companies’ supply chains that have been most impacted by the pandemic. As a result of the crisis, we expect an acceleration of the ongoing trend to create shorter, more sustainable supply chains. While there will still be products that are shipped for efficiency, in many cases the supply chain will move towards domestic production.

It is more important than ever to re-examine supply chains and to ensure that these are managed effectively, and that we underwrite deals with this risk and opportunity in mind.

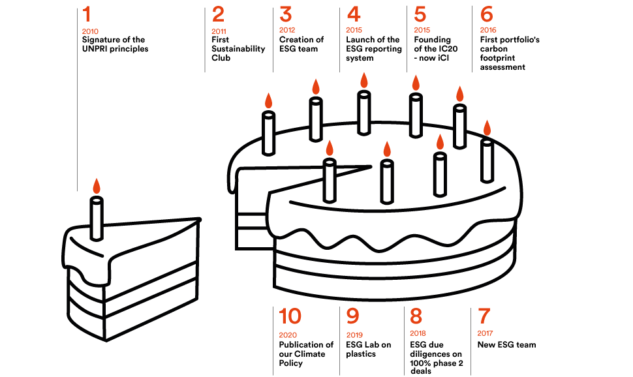

Marking our 10-year anniversary of signing the PRI

When PAI became a signatory to the PRI ten years ago, we wanted to support the best existing initiative in this field. Reflecting on this a decade later, it is clear that ESG was more of a concept than reality at the time, with very few firms adopting a practical ESG focus or applying dedicated ESG teams.

From 2010 to 2015, ESG assessment primarily meant monitoring of our portfolio and beginning to incorporate these factors in our investor relations activities. PAI then established a dedicated ESG Team in 2012 and we have continuously grown our team with specialists from the corporate world, with the objective to encompass operational aspects to create further value.

Our ESG journey is a constant improvement area that will continue to develop over time, but our mindset has evolved dramatically over the past decade. We are committed to improving each of our portfolio companies from an ESG perspective and a big part of this is creating bespoke value creation and ESG plans to support their transformation. We view ESG factors from a holistic and comprehensive perspective and, in retrospect, becoming a signatory of the PRI was just the first of many steps during this fascinating journey.

Today, our approach to improving ESG factors is an indispensable area of engagement within our portfolio and with all of our stakeholders.

Our vision for the ten years ahead

How we view ESG considerations is at the heart of PAI’s investment approach and we are committed to taking our journey to the next level. Our commitment to improving how management teams deliver against ESG factors has proven to be a powerful tool in helping our portfolio companies transform and making them more resilient. We believe it is an area that will become even more integrated in operations and value creation as we improve our ability to quantify its returns.

Today, our focus is to be responsible shareholders while continuing to provide superior returns to investors. We fully believe it is possible to show how improving a company’s commitment to ESG factors translates into value creation. It is already very clear in the public markets that companies that perform well in ESG-related matters trade higher compared to companies that do not.

What started out as a concept ten years ago is today a fundamental driver of value – something further evidenced by the COVID-19 pandemic. This is important as it means that a focus on ESG considerations is now accepted as one of the central value creation levers a GP can use.

The PAI Management Committee