ESG Lab | The plastics issue

The emergence of plastic use, misuse and disposal as an urgent societal, political and investment issue in 2018 teaches investors three things. The first is the speed with which ideas can capture global attention in this connected age. The second is how a seemingly straightforward environmental problem – in this case plastic pollution – evades easy solutions in complex, modern economies. And the third is the importance of avoiding the ‘third rail’ of environmental impact: harming photogenic sea animals.

The broadcast in late 2017 of the BBC’s Blue Planet II series, with its harrowing images of the effects of marine plastics pollution, triggered a surge in public concern about the issue. This was quickly followed by policy and regulatory initiatives around the world, and by a raft of corporate commitments to reduce plastics use.

These developments clearly pose risks for investors – of investee companies alienating customers or facing increased regulatory costs – while also presenting opportunities for more sustainable plastics producers, packaging solutions providers and recyclers. They also demonstrate the complexities involved in handling a material that has become ubiquitous throughout the global economy – and which, alongside its environmental impacts, confers enormous sustainability benefits of its own.

To examine these issues, PAI Partners held an ESG Lab in London on January 16. It brought together 33 participants, including investors managing a total of around $3.4 trillion in assets, portfolio companies and issue specialists to better understand the nature of the environmental problem caused by plastics overuse and pollution, and the associated investment risks and opportunities.

The scale of the plastics problem

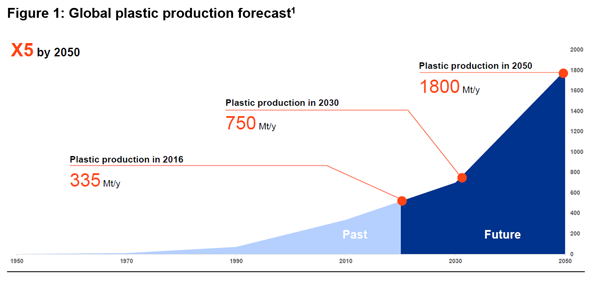

We produce more plastic than any other material, after steel and cement. Its production has grown exponentially since it came into common usage in the 1950s and is set to grow more than five-fold by 2050, from 335 million tonnes/year in 2016 to 1,800 million tonnes.

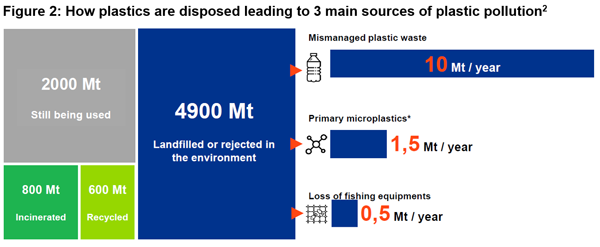

The issue is less around the use of plastic, but how it is disposed of. Since 1950, only 7% of the plastic produced has been recycled, with more than half sent to landfill or dumped in the environment. (Of the rest, around 10% has been incinerated and 30% is still in use.)

On the other hand, plastic is a miracle material. Its economic applications are limitless. It is durable, often recyclable and lightweight. It is the packaging material with the lowest carbon footprint. Its use as a low-cost barrier material prevents enormous volumes of food waste, with the associated economic and carbon savings. While alternatives to plastics – such as glass bottles or cardboard cartons – can appear intuitively attractive, they can often involve unfavourable trade-offs or unintended consequences.

How the plastics value chain is addressing the issue

The ESG Lab involved representatives from four parts of the plastics value chain. Two were from companies in PAI Partners’ portfolio: Perstorp, a Swedish plastics producer, and Netherlands-based Refresco, the world’s largest independent drinks bottler. Speaking with experience derived from investing in leading packaging company, France-based Albéa, was a Partner at PAI. And the retail sector was represented by a senior consultant with deep sector experience. They each outlined some of the challenges created by the public and regulatory response to plastics pollution, and how their parts of the value chain are responding.

Responding to plastics pollution

Workshop participants were asked to consider how companies in the various parts of the value chain might respond to issues around plastics pollution. Three consistent themes emerged:

– A whole value-chain approach – companies throughout the value chain need to understand the composition, use and recyclability of the plastics they produce or consume, and work with their suppliers, customers and recyclers.

– The need to educate customers – companies need to ensure their customers, whether packaging firms, FMCG companies, retailers or the end-consumer, understand why certain plastics are used, the cost and sustainability trade-offs involved, and how to reuse or recycle them.

– The need to lobby government and regulators based on the facts – companies in the plastics value chain have a responsibility to help guide emerging policy, to ensure that regulations are evidence-based, effective and do not lead to unintended consequences.

Investors collaborate

Investors, too, see a need to respond to the issue, and a group of 29 of them, managing around $6 trillion in assets, have joined the plastics investor working group convened by the Principles for Responsible Investment (PRI). The working group is described by its Manager at the PRI, Gemma James, as “a space for investors to learn, and to explore difficult questions around plastics”. Its initial work is focused on understanding the plastics landscape and drawing up resources to help investors engage with investee companies on the topic.

The investment opportunity

This type of engagement is, typically, focused on managing risk from emerging ESG issues. But workshop participants were also asked to suggest what investment opportunities might be presented by efforts to tackle the plastic problem. Some suggested specific investment ideas, such as companies offering packaging-as-a-service, that could ensure the circular reuse of plastic containers.

Others proposed broader themes, such as initiatives to incentivise consumers to return plastics (whether used in packaging or the products themselves) in exchange for discounts. Some participants suggested looking for specific characteristics in investee companies, such as an openness to a discussion around plastics and other ESG issues. One noted that, despite current concern around plastics, the sector as a whole remains attractive, given forecast growth rates and the case that can be made for its positive environmental impact.

Nonetheless, the workshop heard that business as usual is clearly not an option. The combined effects of a growing global population and the growth of consumerism as poorer parts of the world develop will place ever greater strains on the planet’s resources. The adoption of circular economy principles – where waste streams are transformed into inputs – will be essential both to reduce the volume of plastics that end up polluting the natural environment, and to meet spiralling demand for the raw materials from which plastics are made.

In his concluding comments, moderator Mike Tyrrell, Editor of SRI-Connect, summed up the debate around plastics as “alive … The investment debate around plastics and sustainability is alive … And this sustainability issue belongs right at the heart of the investment debate.”